Outlook on E-Invoicing - What's coming?

Starting in 2025, the German government plans to introduce a mandatory E-invoicing requirement for B2B transactions. Companies will then need to be able to receive electronic invoices at a minimum (see also: § 14 para. 1 sentences 2 to 8, para. 2 and 3 UStG, § 27 para. 39 UStG, §§ 33, 34 UStDV-E).

Soon, companies in Germany will only issue E-invoices to each other. They will no longer be able to reclaim input tax from paper invoices, but only from electronic invoices.

The start date for the implementation of this requirement is January 1, 2025.

The Mandatory E-Invoicing Requirement for B2B Transactions Starts in 2025!

Your simple Path to E-Invoicing

With ITISeasy, it’s easy

E-Invoicing Requirement 2025/2026 – What Companies Need to Know Now

The E-Invoicing Requirement – What’s Coming in 2025?

The Path to E-Invoicing – A Well-Thought-Out Concept is Key

Important Clarification: PDF is Not the Same as E-Invoicing

Take Action Now – We Support You!

We’ve compiled the information for you in a concise overview:

Schedule a consultation now

Take Action Now!

ITIS AG already has extensive experience in the field of E-invoicing! Our comprehensive business solution, ITISeasy-business, is perfectly suited to help your company implement everything needed to comply with the E-invoicing requirements.

So, don’t waste any time—schedule a consultation now! We are happy to assist you!

Already using ITISeasy.business? Then you have an advantage! We’d be happy to review with you whether any additions are necessary in light of the E-invoicing requirement!

Outlook on E-Invoicing - what's coming?

Starting in 2025, the German government plans to introduce a mandatory E-invoicing requirement for B2B transactions. Companies will need to be able to at least receive electronic invoices (see also: § 14 para. 1 sentences 2 to 8, para. 2 and 3 UStG, § 27 para. 39 UStG, §§ 33, 34 UStDV-E).

Soon, companies in Germany will only issue E-invoices to each other. They will no longer reclaim input tax from paper invoices, but only from electronic invoices.

From 2026 onward, German companies will also need to be able to create and send E-invoices.

The start dates for the corresponding implementation are January 1, 2025 (at least for receiving E-invoices) and January 1, 2026 (for creating and sending E-invoices).

A Comprehensive Concept - from the Specialists!

re - damit Sie der kommenden E-Rechnungspflicht entspannt entgegen sehen können!Although the digitization and standardization of invoice formats will ultimately relieve businesses in the long run, the transition initially involves some effort! It is crucial to plan with enough lead time and seek support from an experienced specialist to ensure the implementation goes smoothly and saves as much time and unnecessary costs as possible.

"Unfortunately, many businesses plan such IT projects at the last minute, which in this case could lead to an overload of IT service providers," warns the ZDH. These providers could then become the "bottleneck" in creating the necessary IT infrastructure within companies.

Therefore, don’t leave anything to chance. Arrange for the timely installation of the necessary software for your business—so you can approach the upcoming E-invoicing requirement with ease!

ITIS AG – The Ideal Partner for Your E-Invoicing Project!

Good to know: PDF is NOT considered an E-Invoice!

In the future, a distinction will be made between an electronic invoice and an "other invoice." Only invoices issued in an electronic format (according to Directive 2014/55/EU) that can also be processed electronically will be considered as electronic invoices.

Invoices in other electronic formats, such as PDF or on paper, will be classified as "other invoices."

ZUGFeRD and Factur-X

In France, the name Factur-X is used for the Franco-German standard for a standardized electronic invoice format. The format consists of a PDF with an embedded XML file, allowing invoice data to be read and processed electronically. Factur-X is currently available in version 1.0 and is freely accessible. The definition is fully compatible and technically identical to version ZUGFeRD 2.2.

This standard is in compliance with the European standard EN 16931, which defines the implementation and technical rules for electronic invoicing in Europe. The goal is to ensure general interoperability and compliance with legal requirements. The ISO standard PDF/A-3 is also taken into account.

Our first module with the ZUGFeRD format was already created for Odoo version 8, so the application of e-invoices is not new to us.

Outgoing Invoices

Create your invoices quickly and easily as usual with ITISeasy.business. Once all relevant fields are filled out and the draft invoice has been reviewed, the invoice can be booked and finalized.

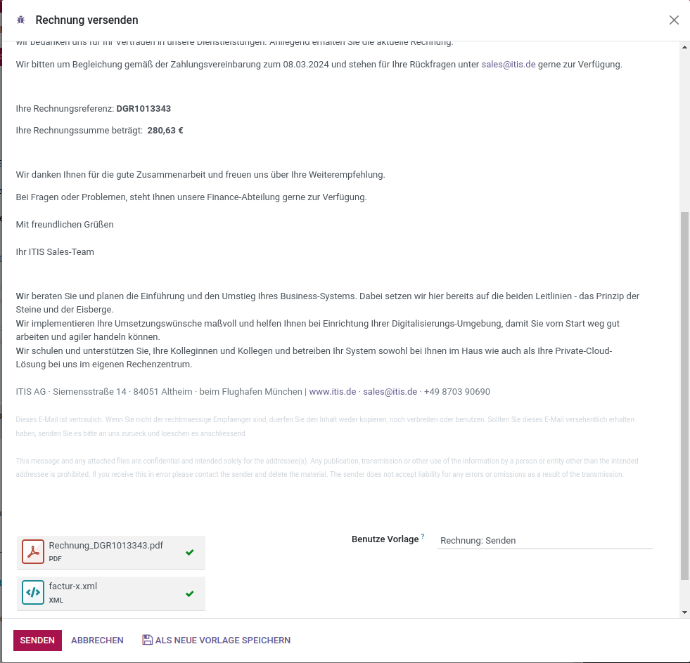

The invoice is then sent directly from ITISeasy.business to the respective recipient. The email is automatically generated from the provided template and includes all the necessary information.

By clicking "Send & Print," the PDF document is sent to the recipient and additionally supplemented with an XML component, allowing the recipient to recognize the invoice as an e-invoice and process it automatically.

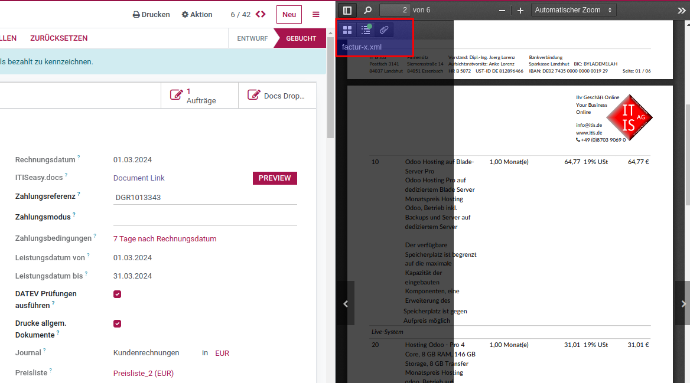

X-Rechnung and XML-Attachment

In addition to the required XML, which is directly embedded within the PDF file, ITISeasy.business can also send a separate XML file.

Along with the invoice file, the XML file will be attached as a separate document when the email is sent to the customer.

The creation and sending of X-invoices in outgoing invoices has been included in our product for years and is already available to you in our ERP system. We are currently working on processing incoming X-invoices as well. This will allow you to easily and legally compliant process your supplier invoices in ITISeasy.business in the future.

We will review the necessary steps and their implementation with you in preparation for the upcoming e-invoice obligation!

Schedule a non-binding consultation appointment today!